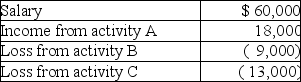

Nancy reports the following income and loss in the current year.

All three activities are passive activities with respect to Nancy.Nancy also has $21,000 of suspended losses attributable to activity C carried over from prior years.During the year,Nancy sells activity C and realizes a $15,000 taxable gain.What is Nancy's AGI as a result of these transactions?

A) $50,000

B) $55,000

C) $64,000

D) $71,000

Correct Answer:

Verified

Q29: Taxpayers are allowed to recognize net passive

Q41: Tom and Shawn own all of the

Q41: Charlie owns activity B which was considered

Q42: Jana reports the following income and loss:

Q48: Jana reports the following income and loss:

Q52: Jeff owned one passive activity.Jeff sold the

Q56: Which of the following is not generally

Q57: Jorge owns activity X which produced a

Q59: Jen and Saachi are the owners of

Q153: Erin, a single taxpayer, has 1,000 shares

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents