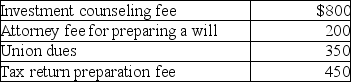

Daniel had adjusted gross income of $60,000,which consisted of $55,000 in wages and $5,000 in dividend income from taxable domestic corporations.His expenses include:

What is the net amount deductible by Daniel for the above items?

A) $400

B) $600

C) $1,000

D) $1,600

Correct Answer:

Verified

Q84: During February and March,Jade spends approximately 90

Q85: Hugh contributes a painting to a local

Q86: Corner Grocery,Inc.,a C corporation with high taxable

Q98: Carl purchased a machine for use in

Q100: Clayton contributes land to the American Red

Q111: Grace has AGI of $60,000 in 2016

Q115: Ivan's AGI is about $50,000 this year,and

Q119: Taxpayers can deduct the fees paid for

Q347: Jorge contributes $35,000 to his church and

Q349: May an individual deduct a charitable contribution

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents