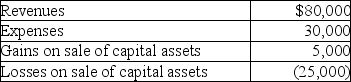

Topaz Corporation had the following income and expenses during the current year:

What is Topaz's taxable income?

A) $30,000

B) $50,000

C) $52,000

D) $20,000

Correct Answer:

Verified

Q74: When an individual taxpayer has NSTCL and

Q83: Sachi is single and has taxable income

Q92: Joel has four transactions involving the sale

Q97: Erik purchased qualified small business corporation stock

Q102: Olivia,a single taxpayer,has AGI of $280,000 which

Q105: Trista,a taxpayer in the 33% marginal tax

Q106: Unlike an individual taxpayer,the corporate taxpayer does

Q106: During the current year,Nancy had the following

Q107: Gertie has a NSTCL of $9,000 and

Q124: Everest Inc.is a corporation in the 35%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents