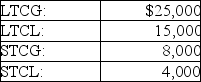

A corporation has the following capital gains and losses during the current year:

The tax result to the corporation is

A) $10,000 NLTCG included in gross income and taxed at ordinary rates; $4,000 NSTCG included in gross income and taxed at reduced rates.

B) $14,000 included in gross income and taxed at reduced rates.

C) $14,000 included in gross income and taxed at ordinary rates.

D) $10,000 NLTCG is included in gross income and taxed at reduced rates; and $4,000 NSTCG included in gross income and taxed at ordinary rates.

Correct Answer:

Verified

Q21: Identify which of the following statements is

Q22: A publicly held corporation is denied a

Q23: If a corporation's charitable contributions exceed the

Q25: Unused charitable contributions of a corporation are

Q27: Musketeer Corporation has the following income and

Q31: A corporation has the following capital gains

Q32: Montage Corporation has the following income and

Q34: With respect to charitable contributions by corporations,all

Q36: A U.S.-based corporation produces cereal in Niagara

Q53: Charades Corporation is a publicly held company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents