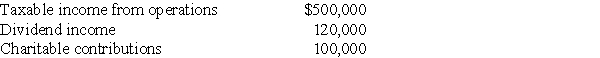

Concepts Corporation reported the following results for the current year:

Taxable income from operations does not include the dividend income or the contributions.The dividend income is from minor investments in U.S.publicly traded stocks.Calculate Concept Corporation's taxable income and any carryovers that may be generated.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: A corporation pays AMT in the current

Q48: One requirement of a personal holding company

Q54: The accumulated earnings tax is imposed on

Q54: Amherst Medical P.C. ,an incorporated group of

Q58: Small Corporation had the following capital gains

Q61: Bartlett Corporation,a U.S.manufacturer,reports the following results in

Q70: Major Corporation's taxable income for the current

Q71: The corporate tax return has been prepared

Q73: Ohio Corporation's taxable income for the current

Q75: Montrose Corporation is classified as a personal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents