Topper Corporation makes a liquidating distribution of land to its sole shareholder Tonya.Topper purchased the land several years ago for $150,000,and the land was recently appraised at $120,000 of value.Tonya purchased her stock three years ago for $65,000.What is the amount of gains or losses recognized by Topper Corporation and Tonya?

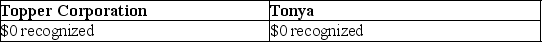

A)

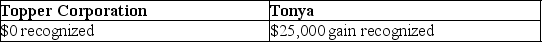

B)

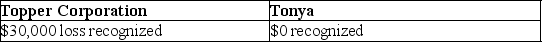

C)

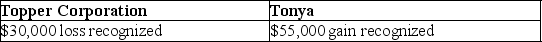

D)

Correct Answer:

Verified

Q101: Corkie Corporation distributes $80,000 cash along with

Q105: Dividends paid from E&P are taxable to

Q111: A closely held corporation will generally prefer

Q112: A new start-up corporation is formed by

Q113: A shareholder receives a distribution from a

Q114: Atomic Corporation is enjoying a very profitable

Q115: A corporation is owned 70% by Jones

Q121: Which corporations are required to file a

Q131: Pursuant to a complete liquidation,Southern Electric Corporation

Q135: A corporation distributes land worth $200,000 to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents