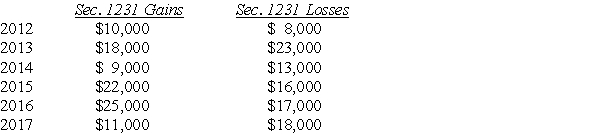

Lucy,a noncorporate taxpayer,experienced the following Sec.1231 gains and losses during the years 2012 through 2017.Her first disposition of a Sec.1231 asset occurred in 2012.Assuming Lucy had no capital gains and losses during that time period,what is the tax treatment in each of the years listed?

Correct Answer:

Verified

2013 $5,000 Ordinary lo...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Aamir has $25,000 of net Sec.1231 gains

Q4: In 2017,Thomas,who has a marginal tax rate

Q5: A net Sec.1231 gain is treated as

Q7: Mark owns an unincorporated business and has

Q9: Jaiyoun sells Sec.1231 property this year,resulting in

Q12: Sec.1231 property must satisfy a holding period

Q13: Why did Congress establish favorable treatment for

Q19: The sale of inventory results in ordinary

Q24: Which of the following assets is 1231

Q32: If the recognized losses resulting from involuntary

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents