Racquet Ltd issued $20 million of convertible notes on 1 July 2003.The notes have a life of 6 years and a face value of $20 each.Annual interest of 5 per cent is payable at the end of each year.The notes were issued at their face value and can be converted at any time over their lives.Organisations with a similar risk profile to Racquet Ltd have issued debt with similar terms but without the option to convert at the rate of 7 per cent.What are the appropriate accounting entries to record the conversion of the notes to equity on 1 July 2004 (after interest has been paid and recorded)?

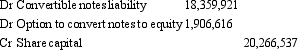

A.

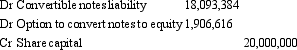

B.

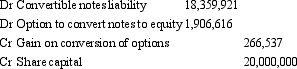

C.

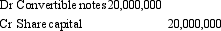

D.

E. None of the given answers.

Correct Answer:

Verified

Q50: Under ASASB 123,interest incurred on a financial

Q51: The amortised cost of a financial asset

Q52: A convertible note may be accurately described

Q53: Two companies enter into loan agreements on

Q54: Which of the following statements about a

Q56: Layton Enterprises and Hewitt Ltd agree to

Q57: For a financial instrument to be classified

Q58: Two companies enter into loan agreements on

Q59: What is the appropriate accounting treatment for

Q60: Prepayments are:

A. Not financial instruments because they

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents