Quaid Ltd entered into a lease agreement on 1 July 2002 to lease equipment on the following terms:  The interest rate implicit in the lease is 8 per cent and the fair value of the leased asset is $24,987.The lease is cancellable if the lessee immediately enters into a further lease for the same or equivalent asset.The economic benefits provided by the lease asset are expected to be consumed evenly over its life.The lease payment has not been made on 30 June before the adjusting entries are made for the year end.What are the appropriate entries in the books of the lessee at the end of the reporting period 30 June 2003?

The interest rate implicit in the lease is 8 per cent and the fair value of the leased asset is $24,987.The lease is cancellable if the lessee immediately enters into a further lease for the same or equivalent asset.The economic benefits provided by the lease asset are expected to be consumed evenly over its life.The lease payment has not been made on 30 June before the adjusting entries are made for the year end.What are the appropriate entries in the books of the lessee at the end of the reporting period 30 June 2003?

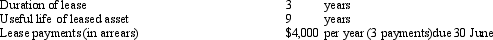

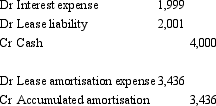

A)

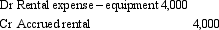

B)

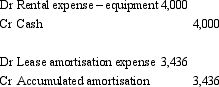

C)

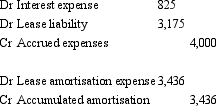

D)

E) None of the given answers.

Correct Answer:

Verified

Q45: Medusa Ltd enters into a non-cancellable 10-year

Q46: A non-cancellable lease is a lease that

Q47: Gerbert Ltd enters into a finance lease

Q48: A finance lease in which the lessor

Q49: Where a sale and leaseback arrangement involves

Q51: From the point of view of the

Q52: Schwann Ltd enters into a non-cancellable 5-year

Q53: Where there is a lease involving a

Q54: The amount of a lease receivable recorded

Q55: Cobalt Ltd owns an item of machinery

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents