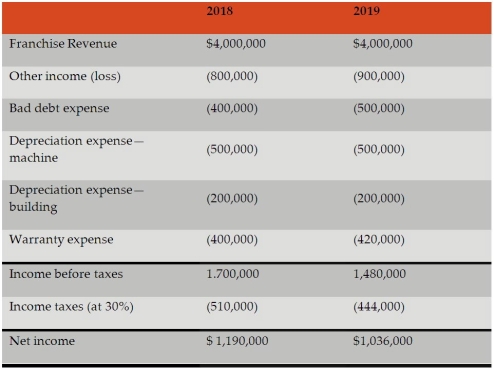

Stretton Company Limited,a private company,was started on January 1,2018.For the first year,the chief accountant prepared the financial statements and a local accountant completed the necessary review of these statements.However,for the year ended December 31,2019,an external auditor was appointed.The income statement for 2018 and the preliminary amounts for 2019 are as follows:

In the process of examining the accounting records the auditor noted the following issues:

In the process of examining the accounting records the auditor noted the following issues:

Franchise Revenue: The Stretton Company signed a franchise agreement to allow a franchisee to operate in a specific area for 10 years.The agreement required the franchisee to pay $4,000,000 initially with a royalty of 2% of sales revenue thereafter.In 2018,the 2% of sales revenue was recorded correctly by Stretton Company.However,management recorded the entire $4,000,000 as having been earned in 2018.In 2019,management realized that 40% of the $4,000,000 pertained to ongoing services to be provided over the next ten years.

Accounts receivable: The Stretton Company uses the aging method to estimate bad debts.During 2019,it was discovered that staff had written off a $103,000 account in 2019,even though the company had received information about the bankruptcy of the client in late 2018.

Machine impairment: Stretton Company has one machine that cost $5,000,000 with a useful life of 10 years and has been depreciated on a straight-line basis for 4 years,including 2019.Stretton carries this asset under the revaluation model and its auditors find that the machine should have been written down for impairments by $450,000 in 2018.No impairment has been recorded by Stretton in 2018 or 2019.

Building depreciation: The company's building (cost $4,000,000,estimated salvage value $0,useful life 20 years)was depreciated last year using the straight line method.The company and the auditor now agree that 10% declining-balance method would be a more appropriate method to use.A depreciation provision of $200,000 has been made for 2018.

Inventories: The accountant failed to apply the lower of cost and net realizable value test to ending inventory in 2018.Upon review,the inventory balance for 2019 should have been reduced by $200,000.The closing inventory allowance balance for 2019 should be $400,000.No entry has been made for this matter.

Warranties: Stretton Company does not accrue for warranties; rather,it records the warranty expense when amounts are paid.Stretton provides a one-year warranty for defective goods.Payments to satisfy warranty claims in 2018 were $400,000,and $420,000 in 2019.Out of the $420,000 paid in 2019,$250,000 related to 2018 sales.A reasonable estimate of warranties payable at the end of 2019 is $375,000.There is nothing relating to 2018 warranty claims left owing at the end of 2019.

Required:

a.As the audit senior on this engagement,what is your recommended treatment for each of these matters in terms of whether they are errors,changes in accounting policy,or changes in estimate? Explain your conclusion.

b.Assume that management of Stretton Company agrees with your recommendations.Prepare the corrected statements of comprehensive income for 2018 and 2019.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q56: Star Company Ltd.,is a private company that

Q57: Victory Welding Company overhauled a printing press

Q58: Sampson Jet Skis manufactures state-of-the-art jet skis.In

Q59: Nadire Company has a December 31 year-end.The

Q60: Zyler Company is analyzing its accounts receivable

Q62: Catherwood Inc.purchased a piece of real estate

Q63: Sawatsky & Company Ltd is involved in

Q64: On January 1,2018,Allied Fittings signed a long-term

Q65: Nicolla Company recorded the purchase of a

Q66: Chesapeake Inc.issued a 7-year bond on October

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents