Sad Man Inc.had 220,000 ordinary shares outstanding in all of 2016.On January 1,2014,Sad issued at par $400,000 in 10% bonds maturing on January 1,2022.Each $1,000 bond is convertible into 9 ordinary shares.Assume that the effective interest rate is 10%.There are 5,000 outstanding cumulative preferred shares that are each entitled to an annual dividend of $0.20.Dividends were not declared or paid during 2016.Each preferred share is convertible into three ordinary shares.Sad's net income for the year ended December 31,2016 was $250,000.Its income tax rate was 35%.

Required:

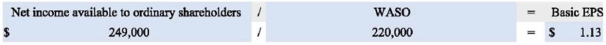

a.Calculate Sad's basic EPS for 2016.

b.Are the convertible bonds dilutive or anti-dilutive in nature? The convertible preferred shares?

c.Calculate Sad's diluted EPS for 2016.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q78: Explain the purpose of incremental EPS.

Q82: Which statement is correct?

A)When convertible securities are

Q84: What are the two assumptions of the

Q85: a. What is the treasury stock method

Q87: Which statement is correct regarding a company

Q88: Which statement is correct?

A)When convertible securities are

Q89: Which statement is correct respecting the presentation

Q100: Calculate the share effect on the incremental

Q101: In 2017,TC Mulch Inc.'s net income was

Q103: Calculate the diluted EPS given the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents