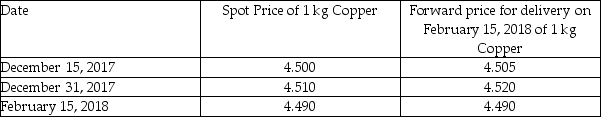

On December 15,2017 Welders Inc.signed a contract to purchase 200,000 kg of copper pipes to be received on February 15,2018.Terms of sale were COD (cash on delivery).Welders,which has a December 31 year-end,entered into a two months forward agreement to purchase the copper to mitigate its price change risk.Welders designated the forward as a cash flow hedge.Pertinent commodity prices follow:

Required:

Required:

Record the required journal entries for December 15,December 31,and February 15 using the net method.If no entries are required,state "no entry required" and indicate why.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q51: Which method must be used under IFRS

Q64: McMillan Manufacturing issued 60,000 stock options to

Q70: O'Neil Manufacturing issued 200,000 stock options to

Q82: Which method must be used under ASPE

Q83: A company located in Canada spends $2,000

Q84: Explain what a "fair value" and "cash

Q85: What is a "hedge"?

A)A financial instrument that

Q92: Give 4 examples of cash flow hedges:

Q98: AnnuG Inc.granted 200,000 stock options to its

Q102: On December 1,2015,Mackenzie Mann Ltd.entered into a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents