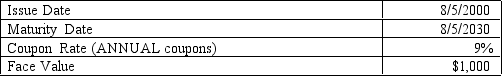

Consider the following details for a bond issued by Bravo Incorporated.

Suppose that today's date is 8/5/2004,what should the current trading price be for this bond if investors want a 12% ANNUAL return?

A) $658.09

B) $763.13

C) $908.88

D) $1,000.00

Correct Answer:

Verified

Q47: If you were trying to describe the

Q48: The relationship between time to maturity and

Q49: A bond pays an ANNUAL coupon rate

Q50: Fence Place Diary Company (FPD)has a 15-year

Q51: With respect to the company that has

Q53: You own a bond that pays a

Q54: Oogle Corp.has decided to do things differently

Q55: You find that the yield on a

Q56: You notice that the price of a

Q57: You find that the yield on a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents