TopCo owns all of the stock of BottomCo.Both taxpayers are subject to the alternative minimum tax (AMT)this year for the first time,due to a dependence on MACRS deductions.The corporations incurred no intercompany transactions during the year.TopCo has a consolidation election in effect for the group.

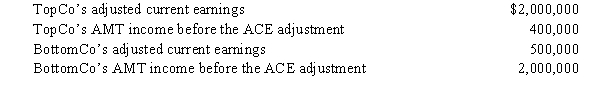

If the affiliates were to file separate Forms 1120 this year,the following amounts would be reported.

a.Compute the ACE adjustment for the consolidated group.

b.Comment on the effects of the consolidation election on the companies' AMT liabilities.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: In computing consolidated taxable income, the purchase

Q115: If the negative adjustments to the stock

Q121: What tax accounting period and methods must

Q123: In a Federal consolidated group,what is an

Q125: Except for the § 199 domestic production

Q126: How do the requirements differ in identifying

Q127: Parent Corporation,SubOne,and SubTwo have filed consolidated returns

Q128: Why do separate corporations form conglomerates,such that

Q129: List the filing requirements that must be

Q143: Describe the general computational method used by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents