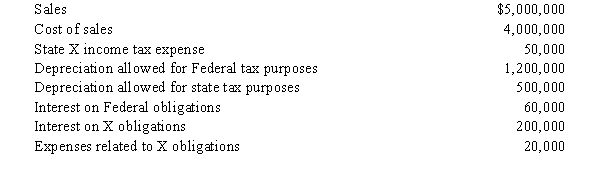

Node Corporation is subject to tax only in State X.Node generated the following income and deductions.State income taxes are not deductible for X income tax purposes.

a.The starting point in computing the X income tax base is Federal taxable income. Derive this amount.

b.Determine Node's X taxable income, assuming that interest on X obligations is exempt from X income tax.

c.Determine Node's taxable income, assuming that interest on X obligations is subject to X income tax.

Correct Answer:

Verified

Q97: The sale of a used auto probably

Q148: Condor Corporation generated $450,000 of state taxable

Q149: Almost all of the states tax a

Q150: Identify several transactions by business taxpayers where

Q151: Although Bowl Corporation's manufacturing facility,distribution center,and retail

Q152: Compute Quail Corporation's State Q taxable income

Q155: Milt Corporation owns and operates two facilities

Q156: Provide the required information for Wren Corporation,whose

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents