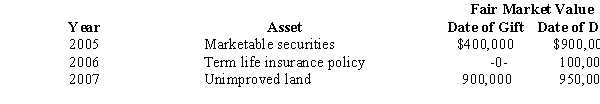

Prior to his death in 2008,Rex made the following gifts.

As a result of the 2007 transfer,Rex paid a gift tax of $70,000. As to these transactions,Rex's gross estate includes:

A) $0.

B) $70,000.

C) $170,000.

D) $1,120,000.

E) None of the above.

Correct Answer:

Verified

Q84: The U.S.has death tax conventions (i.e. ,treaties)

Q97: Before his nephew (Dean)leaves for college,Will loans

Q99: Which of the following statements relating to

Q100: Bernice dies and leaves property to her

Q101: In 2003,Otto dies leaving an after-tax estate

Q103: Winston and Ginger are husband and wife

Q104: Match each statement with the correct choice.

Q105: Match each statement with the correct choice.

Q106: At the time of his death,Jacque was

Q107: In 1980,Marie and Hal (mother and son)purchased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents