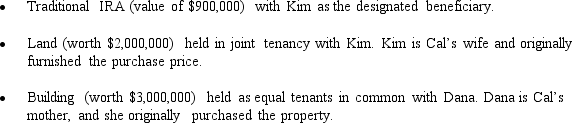

At the time of Cal's death,part of his estate consists of the following.

Under Cal's will,all of his property passes to his wife,Kim.How much marital deduction is Cal's estate allowed?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q128: The Federal gift and estate taxes were

Q136: Waldo is his mother's sole heir and

Q168: How could the § 2513 election to

Q189: Community property law has been influential in

Q191: The deemed paid adjustment compels a taxpayer

Q192: As reflected by the tax law,Congressional policy

Q195: For estate tax purposes,what is the difference

Q196: Rudy owns an insurance policy on the

Q197: In 1982,Jordan and Kinsey acquire realty for

Q199: Bernard's will passes $800,000 of cash to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents