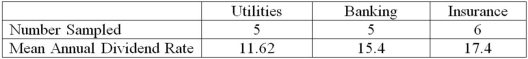

The annual dividend rates for a random sample of 16 companies in three different industries, utilities, banking, and insurance were recorded. The ANOVA comparing the mean annual dividend rate among three industries rejected the null hypothesis that the dividend rates were equal. The mean square error (MSE) was 3.36. The following table summarized the results:  Based on the comparison between the mean annual dividend rate for companies in utilities and banking, the 95% confidence interval shows an interval of 1.28 to 6.28 for the difference. This result indicates that _____________________.

Based on the comparison between the mean annual dividend rate for companies in utilities and banking, the 95% confidence interval shows an interval of 1.28 to 6.28 for the difference. This result indicates that _____________________.

A) there is no significant difference between the two rates

B) the interval contains a difference of 5.00

C) the annual dividend rate in the utilities industry is significantly less than the annual dividend rate in the banking industry

D) the annual dividend rate in the banking industry is significantly less than the annual dividend rate in the utilities industry

Correct Answer:

Verified

Q69: The annual dividend rates for a random

Q70: Below is the information for a completely

Q71: The college of business was interested in

Q72: The college of business was interested in

Q73: A two-way ANOVA with interaction has how

Q76: An ANOVA procedure is applied to data

Q78: In an ANOVA problem involving three treatments

Q78: The annual dividend rates for a random

Q79: If there are 5 levels of Factor

Q80: ANOVA is a statistical approach used to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents