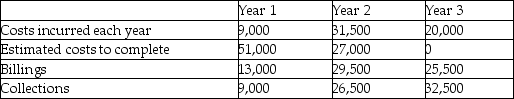

Destiny Apartments Inc. (DA Inc.)is building a luxury condominium for a contract price of $68,000,000. This is estimated to be a three-year project with an estimated cost of $54,000,000. DA Inc. uses the percentage of completion method of revenue recognition, using the cost-to-cost method of estimating the percentage complete. The following is the best available information at the end of each year:

Required:

Required:

a. Explain how the percentage completion method reduced information asymmetry and guards against moral hazard.

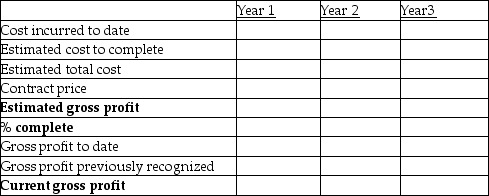

b. Compute the amount of gross profit to be recognized in Year 1, Year 2, and Year 3. Show computations in tabular form provided below:

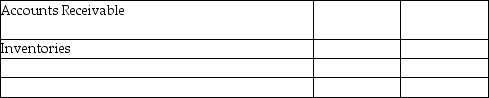

c. Complete the PARTIAL Balance Sheet for Year 2

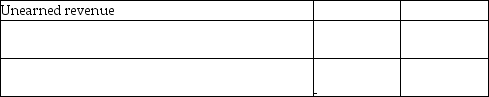

c. Complete the PARTIAL Balance Sheet for Year 2

Current assets

Current Liabilities

Current Liabilities

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q100: Which accounting method is permitted under ASPE

Q101: Soorya Manufacturing makes educational toys that are

Q102: ACME is investing in a new heavy

Q103: Community Apartments Inc. (CA Inc.)is building a

Q104: Explain whether each of the following transactions

Q105: Apartment King (AK)is building a luxury condominium

Q106: Buildings Ltd. is constructing a residential building

Q107: In early 2009, Ecotravel Corp. won a

Q109: Coral Corporation builds large cruise ships on

Q110: Creation Construction Company (CCC)has contracted to build

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents