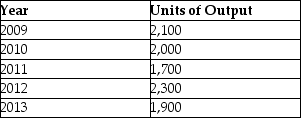

Billu Limited purchased equipment on January 1, 2009 for $275,000. It was estimated that the equipment would have a residual value of $25,000 at the end of its useful life. The asset's useful life was estimated at 5 years or 10,000 units of output. The company has a December 31 year end. Additional Information Assuming the company uses the units-of-production depreciation method, calculate the accumulated depreciation at the end of 2012.

Assuming the company uses the units-of-production depreciation method, calculate the accumulated depreciation at the end of 2012.

A) $57,500

B) $63,250

C) $202,500

D) $222,750

Correct Answer:

Verified

Q86: Discuss how a company can manipulate earnings

Q90: A machine was acquired on January 1,

Q91: At December 31, 2012, the following data

Q91: Which question arises at the time property,

Q92: Ceila Manufacturing purchased equipment on January 1,

Q94: ReelGood Corp. purchased equipment on January 1,

Q94: Explain how the depreciation method should be

Q98: On January 1, 2012, Pheta Company purchased

Q99: A large lathe was bought on January

Q100: The following entry was recorded by Williams

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents