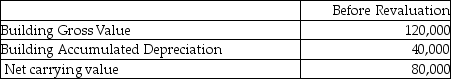

Wilson Inc wishes to use the revaluation model for this property:  The fair value for the property is $140,000. Assuming this is the first year of using the revaluation model, which of the following amounts will be booked?

The fair value for the property is $140,000. Assuming this is the first year of using the revaluation model, which of the following amounts will be booked?

A) $60,000 debit to profit and loss

B) $60,000 credit to profit and loss

C) $60,000 debit to OCI

D) $60,000 credit to OCI

Correct Answer:

Verified

Q22: Wilson Inc wishes to use the revaluation

Q22: Explain the accounting under the revaluation model

Q23: Wilson Inc wishes to use the revaluation

Q24: Company Twelve purchased land for $900,000 some

Q24: Smith Inc wishes to use the revaluation

Q26: Wilson Inc wishes to use the revaluation

Q28: Wallace Inc wishes to use the revaluation

Q32: Company Ten purchased land for $400,000 during

Q32: Smith Inc wishes to use the revaluation

Q33: Company One purchased land for $900,000 some

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents