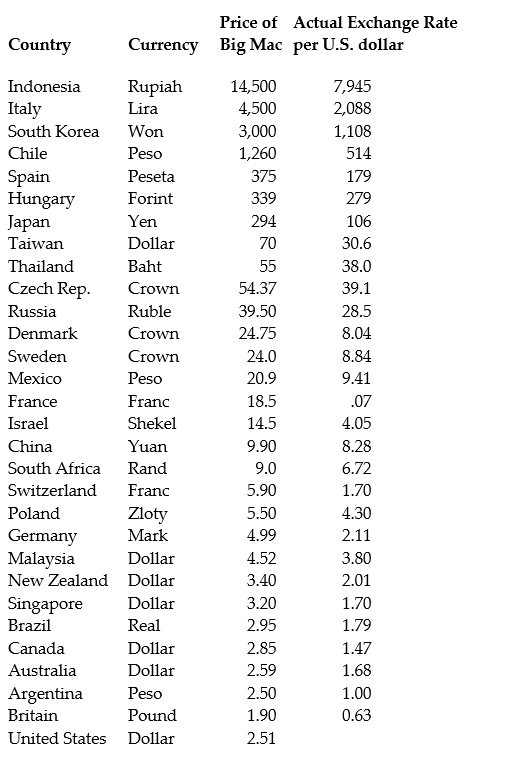

The news-magazine The Economist regularly publishes data on the so called Big Mac index and exchange rates between countries. The data for 30 countries from the April 29, 2000 issue is listed below:

The concept of purchasing power parity or PPP ("the idea that similar foreign and domestic goods … should have the same price in terms of the same currency," Abel, A. and B. Bernanke, Macroeconomics, 4th edition, Boston: Addison Wesley, 476)suggests that the ratio of the Big Mac priced in the local currency to the U.S. dollar price should equal the exchange rate between the two countries.

(a)Enter the data into your regression analysis program (EViews, Stata, Excel, SAS, etc.). Calculate the predicted exchange rate per U.S. dollar by dividing the price of a Big Mac in local currency by the U.S. price of a Big Mac ($2.51).

(b)Run a regression of the actual exchange rate on the predicted exchange rate. If purchasing power parity held, what would you expect the slope and the intercept of the regression to be? Is the value of the slope and the intercept "far" from the values you would expect to hold under PPP?

(c)Plot the actual exchange rate against the predicted exchange rate. Include the 45 degree line in your graph. Which observations might cause the slope and the intercept to differ from zero and one?

Correct Answer:

Verified

(b)The estimated regression is as f...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q26: Changing the units of measurement, e.g. measuring

Q27: For the simple regression model of

Q28: E(ui | Xi)= 0 says

Q29: (Requires Appendix material)At a recent county

Q30: The OLS residuals,

Q32: To decide whether the slope coefficient indicates

Q33: Multiplying the dependent variable by 100 and

Q34: To obtain the slope estimator using the

Q35: In 2001, the Arizona Diamondbacks defeated

Q36: You have obtained a sub-sample of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents