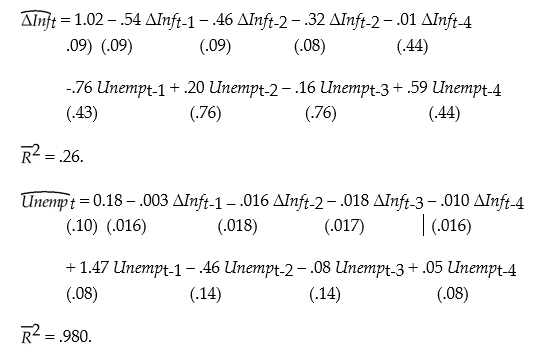

You have collected quarterly data on inflation and unemployment rates for Canada from 1961:III to 1995:IV to estimate a VAR(4)model of the change in the rate of inflation and the unemployment rate. The results are

(a)Explain how you would use the above regressions to conduct one period ahead forecasts.

(b)Should you test for cointegration between the change in the inflation rate and the unemployment rate and, in the case of finding cointegration here, respecify the above model as a VECM?

(c)The Granger causality test yields the following F-statistics: 3.75 for the test that the coefficients on lagged unemployment rate in the change of inflation equation are all zero; and 0.36 for the test that the coefficients on lagged changes in the inflation rate are all zero. Based on these results, does unemployment Granger-cause inflation? Does inflation Granger-cause unemployment?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: In a VECM,

A)past values of Yt -

Q21: Think of at least five examples from

Q22: Consider the GARCH(1,1)model

Q23: The BIC for the VAR is

A)BIC(p)=

Q24: The EG-ADF test

A)is the similar to the

Q26: A VAR with k time series variables

Q27: The DOLS estimator has the following property

Q28: Using the ADL(1,1)regression Yt = ?0

Q29: Some macroeconomic theories suggest that there is

Q30: You have collected quarterly data for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents