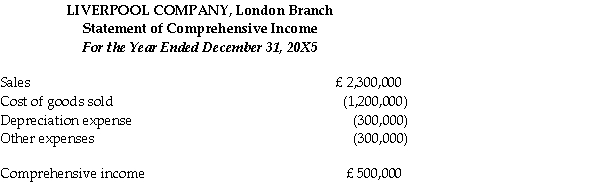

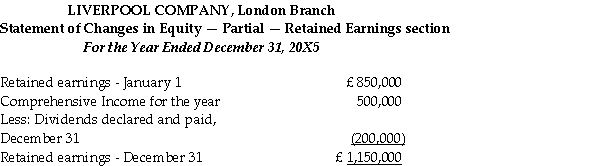

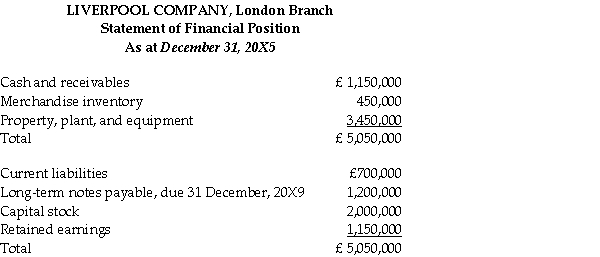

Liverpool Company operates retail stores in Canada and an exporting business in London that specializes in buying and selling British tweeds.The London subsidiary provided the following financial statements in pounds sterling to the Canadian parent company.

Liverpool Company was incorporated on January 1,1984,at which time an amount of property,plant,and equipment with a present (December 31,20X5)Net Book Value of £3,000,000 was purchased.Additional equipment was purchased December 31,20X4 (20% of depreciation expense relates to this new equipment).The long-term notes were issued,to replace financing provided by the parent,on January 1,20X4.

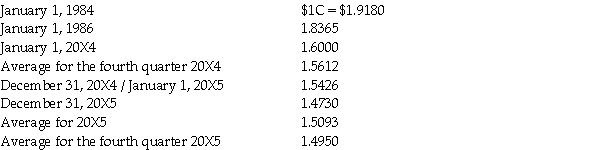

Direct exchange rates for the pound sterling (1 $C/£ )are:

The January 1,20X5 retained earnings balance of the London Branch of the Liverpool Company correctly translated to Canadian dollars was $1,783,774.The beginning inventory of £380,000 was acquired during the last quarter of 20X4 and the ending inventory was acquired during the last quarter of 20X5.Sales and purchases were made,and other expenses were incurred,evenly throughout the year.

Required:

Compute the gain or loss on holding net monetary items for the Liverpool Company for the year ending December 31,20X5.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q27: DNA was incorporated on January 2,20X0 and

Q28: Under the temporal method,how is an exchange

Q28: If a foreign currency is strengthening with

Q29: Liverpool Company operates retail stores in Canada

Q30: Under the temporal method,at what exchange rate

Q32: For publicly accountable companies, with foreign operations

Q34: For private enterprises that use the current-rate

Q34: Liverpool Company operates retail stores in Canada

Q35: DNA was incorporated on January 2,20X0 and

Q36: Under the current-rate method,at what exchange rate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents