Coral Ltd.owns 100% of Ambrose Ltd.Coral uses the cost method to record this subsidiary.Coral received $150,000 in dividends from Ambrose.What journal entry should Coral make on its consolidation worksheet with respect to the dividends?

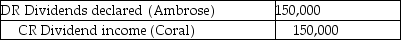

A)

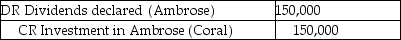

B)

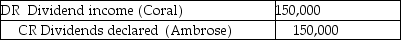

C)

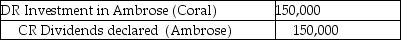

D)

Correct Answer:

Verified

Q1: Piri Ltd. acquired 100% of the commons

Q3: Waite Co.is a subsidiary of Star Ltd.During

Q6: DC Company purchased 100% of the outstanding

Q7: The goodwill impairment test does not involve

Q8: Mitzy's Muffins Ltd.purchased a commercial baking system

Q9: A parent company can record an investment

Q10: DIY Ltd.owns 20 subsidiary companies.Most of the

Q11: DC Company purchased 100% of the outstanding

Q15: Under the direct method, what values should

Q32: What does "one-line consolidation" refer to?

A)Cost method

B)Equity

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents