In 20X1,a parent company sold a tract of land to its subsidiary for $100,000,resulting in a $30,000 loss.The subsidiary's plans for the land did not materialize and it still owned the land at the end of 20X4.At the end of 20X4,what consolidating journal entry should be made with respect to the loss associated with the sale of land?

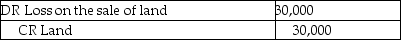

A)

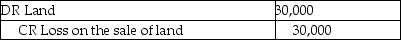

B)

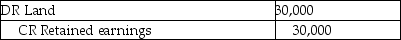

C)

D)

Correct Answer:

Verified

Q18: Fair value increments on depreciable assets _.

A)should

Q21: On September 1,20X5,CanAir Limited decided to buy

Q22: On September 1,20X5,CanAir Limited decided to buy

Q23: On December 31,20X1,Dad Ltd.purchased 100% of the

Q26: Which of the following consolidation adjustments will

Q26: On December 31,20X2,the Pipe Ltd.purchased 100% of

Q27: On December 31,20X5,Space Co.purchased 100% of the

Q28: On the date that a company acquires

Q33: In consolidating parent-founded subsidiaries, what account is

Q39: In consolidating a wholly owned parent-founded subsidiary,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents