Sugar Corp and Syrup Limited have reached an agreement in principle to combine their operations as of October 1,20X9.However,the Board of directors cannot decide on the best way to accomplish the combination.Below are the alternatives being considered:

1.Sugar acquires the net assets of Syrup for $1,700,000 cash.

2.Sugar acquires only the assets for $2,650,000 cash.

3.Sugar acquires all of the outstanding shares of Syrup by issuing shares with a fair market value of $1,700,000.

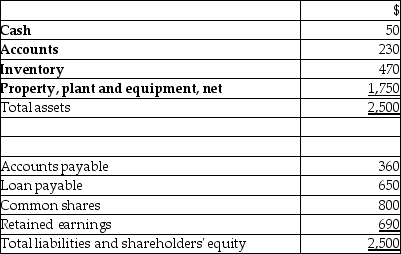

Syrup has the following assets and liabilities at October 1,20X9,(in thousands of dollars)

The only item that has a fair value different from its carrying value is the property,plant and equipment,which has a fair value of $1,900.

Required:

Explain how each transaction is different from the acquirer's point of view.Prepare the journal entry that would be recorded by Sugar for each these alternatives.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q31: Nashman Ltd.is a private enterprise with five

Q32: On December 31,20X5,CI Co.purchased 100% of the

Q33: On December 31,20X6,the statements of financial position

Q34: On March 17,20X2,Cho Co.acquired 100% of the

Q35: Hurricane Inc.wants to acquire 100% of the

Q36: Ski Ltd.has 500,000 shares outstanding.On July 1,20X7,Ski

Q37: Which of the following statements about a

Q38: Dupuis Ltd.acquired Waul Ltd.through a business combination

Q39: There are a number of possible approaches

Q40: Slade Co.has 1,000,000 shares outstanding and is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents