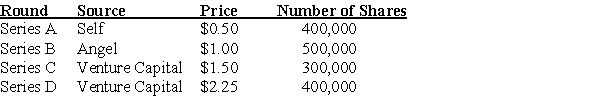

David found a company and goes through the investment rounds shown below:

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.What will be the IPO price per share?

A) $3.40

B) $20.25

C) $33.33

D) $60.00

Correct Answer:

Verified

Q7: Which of the following statements is FALSE?

A)After

Q32: Which of the following statements is FALSE?

A)Once

Q37: Which of the following statements is FALSE?

A)In

Q43: What is the major reason that underwriters

Q47: David found a company and goes through

Q48: The founders and owners of a private

Q50: Which of the following statements is FALSE?

A)

Q52: The founder of a company currently holds

Q53: Which of the following best describes a

Q54: ![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents