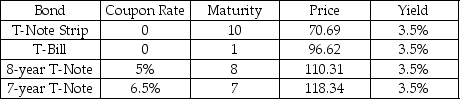

Each bond in the table has a face value of $100.The coupon bonds pay annual coupons,and the next coupon is due in one year.Assume that the yield curve is flat and all yields are currently 3.5%.If interest rates are forecast to rise to 4% from 3.5%,then what is the percentage change in price for the bond whose price changes the most?

A) -4.4%

B) -3.5%

C) -2.5%

D) -1.5%

E) -0.5%

Correct Answer:

Verified

Q59: You can buy a bond with a

Q60: Bank of America bonds are currently trading

Q61: A US Government 4% coupon bond has

Q62: Assume that the Microsoft bonds have a

Q63: A $1,000 face value bond has a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents