Tom Morrison Inc.,a leading manufacturer of golf equipment,is currently evaluating a new golf ball called the 'Feathery'.The secret to the Feathery is that its core is made from goose down.The advantage of down is that the ball flies higher and longer.You have been asked to analyze The Feathery project and present your findings to the company's executive committee.

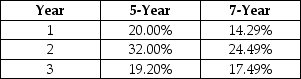

The production line would be set up in an unused section of Morrison's main plant.The machinery is estimated at $480,000.Further,Morrison's inventories would have to be increased by $50,000 to handle the new line.The machinery is depreciated using MACRS with a 7-year recovery period.The machinery will be used for 2 years and have an expected salvage value of $200,000 at the end of that time.Morrison's tax rate is 30% and its weighted average cost of capital is 10%.

Operating earnings (EBITDA) are expected to be $330,000 per year for each of the two years.Assume that the purchase of the machine and increase in inventory occur at the beginning of the first year of operations.Assume that operating cash flows occur at the end of each of the two years of operations.What is initial cash flow for the Feathery project?

MACRS Depreciation Rates

A) -$530,000

B) -$480,000

C) -$430,000

D) -$50,000

E) $0

Correct Answer:

Verified

Q35: After a trip to Bordeaux France you

Q36: Orange Inc.,the Cupertino-based computer manufacturer,has developed a

Q37: You estimate that if a new 4D

Q38: The relevant cash flows for capital budgeting

Q39: John Kay Inc.is considering the installation of

Q41: The Boeing Corp.is considering building a new

Q42: Jones Crusher Company is evaluating the proposed

Q43: The Munsell Colour Company is considering the

Q44: The Boeing Corp.is considering building a new

Q45: Dr.Magneto is evaluating whether to open a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents