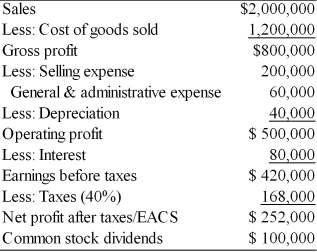

Table 4.6

Income Statement

Ace Manufacturing, Inc.

For the Year Ended December 31, 2010

-Ace Manufacturing, Inc., is preparing pro forma financial statements for 2011. The firm utilized the percent-of-sales method to estimate costs for the next year. Sales in 2010 were $2 million and are expected to increase to $2.4 million in 2011. The firm has a 40 percent tax rate.(a) Given the 2010 income statement in Table 4.6, estimate net profit and retained earnings for 2011.

(b) If $200,000 of the cost of goods sold and $40,000 of selling expense are fixed costs; and the interest expense and dividends are not expected to change, what is he dollar effect on net income and retained earnings? What is the significance of this effect?

Correct Answer:

Verified

Pro forma income statement: December...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q144: Table 4.3

The financial analyst for Sportif, Inc.

Q147: Table 4.3

The financial analyst for Sportif, Inc.

Q150: Table 4.3

The financial analyst for Sportif, Inc.

Q156: In the next planning period, a firm

Q158: Table 4.3

The financial analyst for Sportif, Inc.

Q164: Income Statement

Huddleston Manufacturing Company

For the Year Ended

Q165: The ZZZ Mattress Co. has been requested

Q173: Table 4.5

A financial manager at General Talc

Q178: A weakness of the percent-of-sales method to

Q179: Table 4.5

A financial manager at General Talc

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents