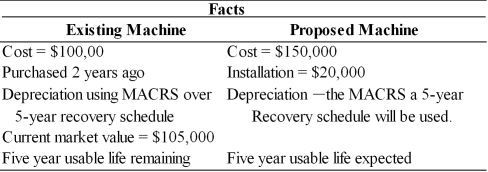

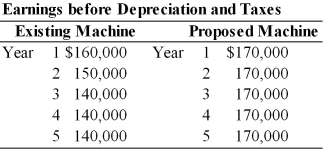

Table 11.6

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given.

The firm pays 40 percent taxes on ordinary income and capital gains.

The firm pays 40 percent taxes on ordinary income and capital gains.

-Calculate the initial investment required for the new asset. (See Table 11.6)

Correct Answer:

Verified

Q79: A machine was purchased two years ago

Q80: Table 11.4

Computer Disk Duplicators, Inc. has been

Q81: Table 11.4

Computer Disk Duplicators, Inc. has been

Q82: Table 11.5

Cuda Marine Engines, Inc. must develop

Q83: Table 11.6

Degnan Dance Company, Inc., a manufacturer

Q85: Table 11.5

Cuda Marine Engines, Inc. must develop

Q86: Table 11.5

Cuda Marine Engines, Inc. must develop

Q87: Table 11.4

Computer Disk Duplicators, Inc. has been

Q88: Table 11.5

Cuda Marine Engines, Inc. must develop

Q89: Table 11.4

Computer Disk Duplicators, Inc. has been

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents