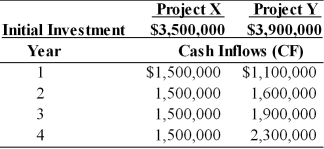

Table 11.11

Nico Manufacturing is considering investment in one of two mutually exclusive projects X and Y which are described below. Nico Manufacturing's overall cost of capital is 15 percent, the market return is 15 percent and the risk-free rate is 5 percent. Nico estimates that the beta for project X is 1.20 and the beta for project Y is 1.40.

-Calculate the NPV of projects X and Y assuming that the firm did not employ the RADR method and instead used the firm's overall cost of capital to evaluate projects X and Y. (See Table 11.11)

Correct Answer:

Verified

Q83: The objective of capital rationing is to

Q94: In selecting the best group of unequal-lived

Q94: A firm with limited funds for investment

Q99: The objective of capital rationing is to

Q101: The IRR approach to capital rationing involves

Q102: The objective of _ is to select

Q176: Table 11.12

Yong Importers, an Asian import company,

Q177: Table 11.12

Yong Importers, an Asian import company,

Q178: Table 11.11

Nico Manufacturing is considering investment in

Q179: Table 11.12

Yong Importers, an Asian import company,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents