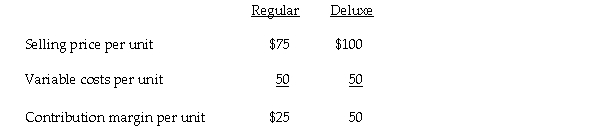

The Orton Company produces two types of food processors. Information about the two products for 2006 is as follows:  The company expects fixed costs to be $150,000 in 2006. The firm expects 80% of its sales (in units) to be Regular model food processors.

The company expects fixed costs to be $150,000 in 2006. The firm expects 80% of its sales (in units) to be Regular model food processors.

a. Determine the break-even point in units.

b. Determine sales in units of Regular and Deluxe models necessary to generate a before-tax profit of $90,000.

c. Determine sales in units of Regular and Deluxe models necessary to generate an after-tax profit of $90,000 if the tax rate is 40 percent.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q87: The relative proportions of quantities of products

Q87: A firm's ratio of fixed and variable

Q88: Wallace, Inc. produces squirt guns and has

Q89: The level of sales at which revenue

Q90: Given the following information for Baugh Company:

Q91: The boundaries of cost driver activity within

Q93: The sales price minus all the variable

Q94: Dopler Inc. manufactures a product that sells

Q95: Thornburg Corporation manufactures lamps. Given the following

Q141: A cost that is not immediately affected

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents