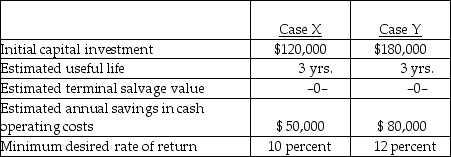

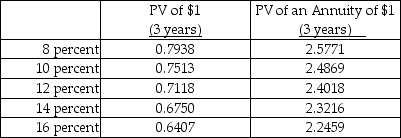

Below are two potential investment alternatives:

-Assume straight-line amortization in all computations, and ignore income taxes. The net present value in case Y is

A) $80,000.

B) $12,144.

C) $(328) .

D) $123,056.

Correct Answer:

Verified

Q12: Alpha Company has the following information:

Q13: Alpha Company has the following information:

Q14: Alpha Company has the following information:

Q15: Both the payback and the accounting rate-of-return

Q16: When no revenue is involved, organizations try

Q18: Below are two potential investment alternatives:

Q19: One purpose of a postaudit is to

Q20: The net present value model expresses all

Q21: Beta Company has the following information:

Q22: Beta Company has the following information:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents