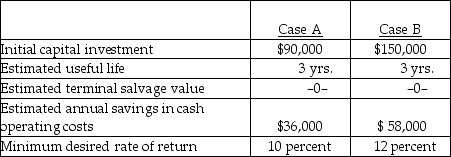

Below are two potential investment alternatives:

Assume straight-line amortization in all computations, and ignore income taxes.

Assume straight-line amortization in all computations, and ignore income taxes.

-In capital budgeting, the relevant tax rate to consider is the

A) prior year tax rate.

B) average rate expected for the company.

C) marginal rate expected for the company.

D) highest rate that applies to U.S. corporations.

Correct Answer:

Verified

Q13: Alpha Company has the following information:

Q22: Beta Company has the following information:

Q23: Below are two potential investment alternatives:

Q24: Beta Company has the following information:

Q26: Below are two potential investment alternatives:

Q28: Below are two potential investment alternatives:

Q29: Below are two potential investment alternatives:

Q30: Below are two potential investment alternatives:

Q31: Below are two potential investment alternatives:

Q32: Beta Company has the following information:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents