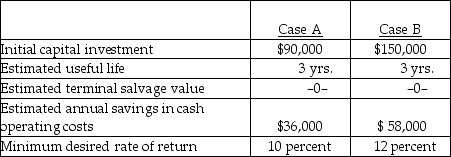

Below are two potential investment alternatives:

Assume straight-line amortization in all computations, and ignore income taxes.

Assume straight-line amortization in all computations, and ignore income taxes.

-The marginal tax rate is

A) the average rate for the company.

B) the highest possible rate the company might be expected to pay.

C) the lowest tax rate applicable to the company.

D) the rate paid on additional amounts of pretax income.

Correct Answer:

Verified

Q40: Below are two potential investment alternatives:

Q41: Inflation is

A) not a factor in most

Q42: If a company pays taxes of 15

Q43: If a company pays taxes of 20

Q44: A company with pretax income of $45,000

Q46: Which of the following is not true

Q47: Which of the following is NOT usually

Q48: When making capital-budgeting decisions, the effects of

Q49: A company is considering the purchase of

Q50: A company with pretax income of $60,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents