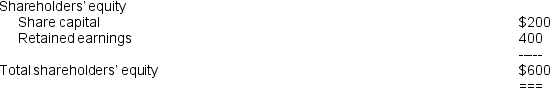

On July 1 20X5,Helios Ltd acquired all of the share capital of Havers Pty Ltd (100,000 shares) for $10 per share.Immediately subsequent to acquisition,the directors of Havers Ltd declared and paid a dividend of $60,000 from the retained earnings at June 30 20X5.During the year ended June 30 20X6,Helios Ltd received an interim dividend of $40,000 from Havers Ltd and the directors of Havers Ltd declared a final dividend of $60,000.At the date of acquisition,July 1 20X5,the shareholders' equity of Havers Ltd was (amounts in thousands) :  At the date of acquisition,the carrying amounts of the net assets of Havers Ltd approximated fair value.If a consolidated balance sheet were to be prepared for Helios Ltd and its subsidiaries at the date of acquisition,the consolidation adjustment to eliminate the investment in the subsidiary would be:

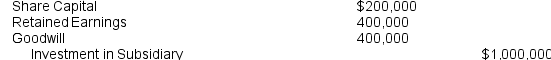

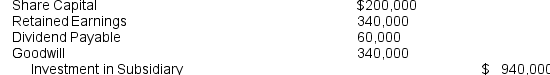

At the date of acquisition,the carrying amounts of the net assets of Havers Ltd approximated fair value.If a consolidated balance sheet were to be prepared for Helios Ltd and its subsidiaries at the date of acquisition,the consolidation adjustment to eliminate the investment in the subsidiary would be:

A)

B)

C)

D) none of the above

Correct Answer:

Verified

Q1: In a consolidation,it would be double counting

Q2: The investment date and the acquisition date

Q5: Post-acquisition changes in the composition of pre-acquisition

Q9: Discuss the changes in the accounting rules

Q19: Assume the same data as in Question

Q20: A subsidiary which is identified as a

Q20: Dividends payable by a subsidiary on an

Q22: Changes in fair value of contingent consideration

Q27: Explain the consequences of distinguishing between pre

Q38: Explain why the existence of goodwill enables

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents