Assuming the same facts as for Question 12 but that 2 years later S sold the land outside the group for $1,200,000 the consolidation journal entry required would be (ignoring tax effects) :

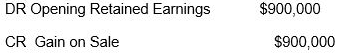

A)

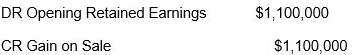

B)

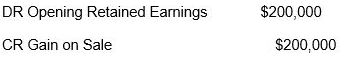

C)

D) no entry required

Correct Answer:

Verified

Q4: Consolidation entries never adjust cash because intragroup

Q6: A Ltd sells inventory to its parent

Q6: P Ltd sold an item of property

Q7: Using the same facts as Question 14

Q8: Which of the following accounts cannot be

Q9: A consolidation adjustment will have a tax

Q9: P Ltd acquired inventories for $150,000 which

Q10: Unrealised profits on intra-group sale of inventories

Q14: Dividends paid by the parent company and

Q19: A parent company owns 80% of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents