The following data relate to Questions 18-22:

During the year ended June 30 20X7, Johnson Ltd became deeply involved in trade with Malaysia. On July 1 20X6, the company acquired 50% of the share capital of a Malaysian palm oil producer, Plantations Berhad, for $7,000,000. For the year ended June 30 20X7, the following balance sheet and income statement were prepared by Plantations Berhad (amounts in thousands) :

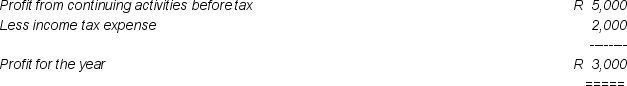

Income Statement for the Year ended June 30 20X7

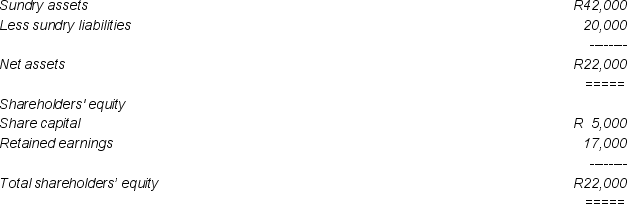

Balance Sheet as at June 30 20X7

Balance Sheet as at June 30 20X7

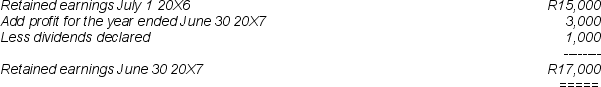

Statement of the Movement in Retained Earnings in the Year ended June 30 20X7

Statement of the Movement in Retained Earnings in the Year ended June 30 20X7

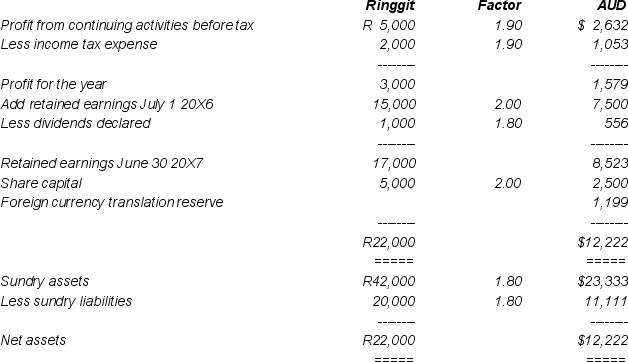

The functional currency of Plantations Berhad was Malaysian Ringgit. The following translation statement was prepared for the company (amounts in thousands) :

The functional currency of Plantations Berhad was Malaysian Ringgit. The following translation statement was prepared for the company (amounts in thousands) :

Additional information:

Additional information:

a) A deferred tax liability of 30% of the foreign currency translation reserve is to be recognised.

b) On July 1 20X6, as a partial hedge against its investment in Plantations Berhad, Johnson Ltd took out a three (3) year loan of R 8,000,000 from the Bank Negara at 12% interest, with interest payable quarterly commencing September 30 20X6.

c) On May 15 20X7 Johnson Ltd placed an order for R 2,000,000 in merchandise for resale from Malaysian Industries Berhad, payable in USD. The goods were shipped FOB on May 31 with settlement due on July 31 20X7.

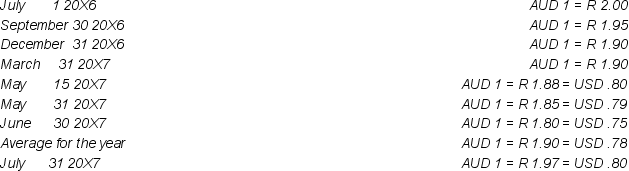

At relevant dates the exchange rates were:

-In the separate income statement of Johnson Ltd for the year ended June 30 20X7,the translation gain or loss arising on the loan from the Bank Negara was (rounded to the nearest thousand dollars) :

A) A translation gain of $311,111

B) A translation loss of $444,000

C) A translation loss of $600,000

D) Nil, since any loss is initially recognised in equity.

Correct Answer:

Verified

Q7: The following data relate to Questions 18-22:

During

Q8: Under the temporal method,all revenue and expense

Q8: The following data relate to Questions 18-22:

During

Q9: Under the current rate method foreign exchange

Q10: An exchange rate quoted in Australia of

Q13: Alternative exchange rates which can be used

Q14: Where the functional currency of a foreign

Q15: A 'natural hedge' occurs when an Australian

Q16: Translation of financial statements into the presentation

Q29: Cash flows from foreign operations denominated in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents