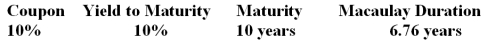

Steel Pier Company has issued bonds that pay semiannually with the following characteristics:

-If the yield to maturity decreases to 8.045% the expected percentage change in the price of the bond using Macauley's duration would be ____,while the expected percentage change in the price of the bond using modified duration would be ____.

A) 11%, 12%

B) 12%, 11%

C) 12%, 12%

D) 11%, 11%

Correct Answer:

Verified

Q62: If an investment returns a higher percentage

Q65: What strategy might an insurance company employ

Q66: Immunization of coupon paying bonds is not

Q67: You have an investment horizon of 6

Q68: A 20 year maturity corporate bond has

Q71: A zero coupon bond is selling at

Q72: Steel Pier Company has issued bonds that

Q73: You have an investment horizon of 6

Q74: Which one of the following statements correctly

Q76: When bonds sell above par, what is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents