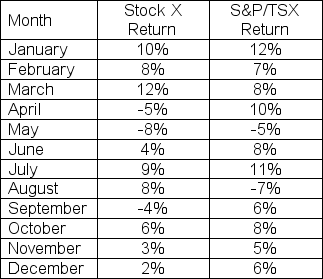

Given the following information:

a) What are the average monthly returns on Stock X and the S&P TSX?

b) What are the standard deviations of the monthly returns on Stock X and the S&P TSX?

c) What is the covariance of the returns on Stock X and the S&P TSX?

d) What is the beta of Stock X?

e) What is the implied risk-free rate?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q98: The expected return on the market is

Q99: Which one of the following is NOT

Q100: The expected return on the market is

Q101: Is it possible to invest more than

Q104: "There may be some truth in the

Q105: You have two portfolios,A and B.Portfolio A

Q105: What is the role of the risk-free

Q106: The risk-free rate is 4 percent.The expected

Q108: Stock ABC is currently selling for $16.72.It

Q109: If two stocks had the same beta,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents