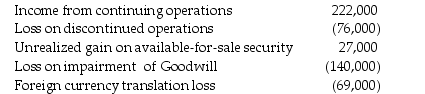

Gerogi Company had the following balances for income from continuing operations and pretax gains and losses on December 31:  The company's effective tax rate is 40%.What amount should Gerogi Company report as comprehensive income for the year ended December 31?

The company's effective tax rate is 40%.What amount should Gerogi Company report as comprehensive income for the year ended December 31?

A) $95,200

B) $104,000

C) $151,200

D) $196,800

Correct Answer:

Verified

Q105: Bandana Company had the following balances for

Q109: Other comprehensive income includes gains and losses

Q110: Bass Steel provided the following partial-trial balance

Q111: How is reporting for other comprehensive income

Q112: Currently,under U.S.GAAP,what are the four items of

Q114: IFRS allows companies to include in Other

Q115: Which of the following is an advantage

Q119: Which of the following transactions is not

Q121: Which of the following is not an

Q137: Which of the following is not an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents