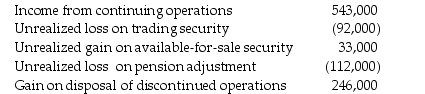

Gerogi Company had the following balances for income from continuing operations and pretax gains and losses on December 31:  The company's effective tax rate is 40%.What amount should Gerogi Company report as comprehensive income for the year ended December 31?

The company's effective tax rate is 40%.What amount should Gerogi Company report as comprehensive income for the year ended December 31?

A) $426,000

B) $495,600

C) $606,400

D) $643,200

Correct Answer:

Verified

Q104: Other comprehensive income includes unrealized gains and

Q115: Which of the following transactions is not

Q116: Golgotha Industries provided the following partial-trial balance

Q121: Clowns-R-Us reported the following in the statement

Q123: Which of the following is false concerning

Q124: Biglo Chemical Company reported the following in

Q125: List the five component accounts included in

Q125: The Stockholders' Equity section of 20X1 balance

Q128: Under IFRS, the statement of stockholders' equity

Q129: What two alternatives does a company have

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents