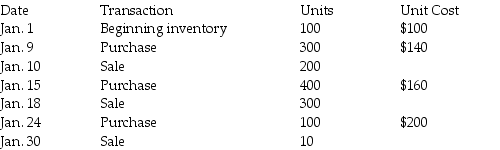

The Butters Company uses the FIFO perpetual inventory system.The company has the following data available for the month of January:

The selling price per unit is $1,000.Selling and administrative expenses for the month total $100,000.Interest expense for the month is $10,000.The tax rate is 30%.

The selling price per unit is $1,000.Selling and administrative expenses for the month total $100,000.Interest expense for the month is $10,000.The tax rate is 30%.

Required:

Prepare the income statement for the month ending January 31,2015 using a multiple-step format.

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q66: Dollar-value LIFO computes inventory on a pool

Q69: The LIFO reserve is disclosed in the

Q75: Goodee Bakery is considering a change in

Q77: When following U.S. GAAP, the market value

Q78: Michael Jones Company has adopted the dollar-value

Q82: A company uses the conventional retail method

Q83: At December 31,the Selig Company has ending

Q84: When following U.S. GAAP, the lower-of-cost-or-market rule

Q85: At the end of the year,Katerinos Company

Q88: Following IFRS, reversal of an inventory write-down

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents