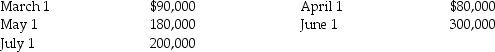

On March 1,Orono Co.began construction of a small building.The following expenditures were incurred for construction:

The building was completed and occupied on July 1.To help pay for construction $50,000 was borrowed on March 1 on a 12%,three-year note payable.The only other debt outstanding during the year was a $500,000,10% note issued two years ago.

The building was completed and occupied on July 1.To help pay for construction $50,000 was borrowed on March 1 on a 12%,three-year note payable.The only other debt outstanding during the year was a $500,000,10% note issued two years ago.

Required:

(a)Calculate the weighted-average accumulated expenditures.

(b)Calculate avoidable interest.

Correct Answer:

Verified

Q21: Adding new offices to an existing office

Q22: Ordinary repairs are expenditures to maintain the

Q24: Assets that qualify for interest cost capitalization

Q26: When computing the amount of interest cost

Q28: Depreciation is the systematic allocation of the

Q33: Ballyhigh Company purchased equipment for $20,000.Sales tax

Q36: Woowee Company manufactures electric motorcycles.On April 1,it

Q37: Scrap value reduces the depreciable base of

Q39: Emerson Enterprises is constructing a building.Construction began

Q40: What criteria does a company use to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents