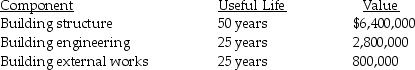

Presented below are the components related to an office building that Lorny Manufacturing Company purchased for $10,000,000 in January,2017.

a.Compute depreciation expense for 2017,assuming that Lorny uses component depreciation,uses the straight-line method of depreciation,and ignores scrap values.

a.Compute depreciation expense for 2017,assuming that Lorny uses component depreciation,uses the straight-line method of depreciation,and ignores scrap values.

b.Assume that the building engineering was replaced after 20 years at a cost of $2,500,000.Prepare the journal entry to record the replacement of the old component with the new component.

Correct Answer:

Verified

Q31: Double-declining balance method charges twice the amount

Q38: Accumulated depreciation is a contra-expense account that

Q41: For income statement purposes,when is depreciation expense

Q42: What type of account is Accumulated Depreciation?

A)

Q44: The depreciable base of an asset for

Q48: A production machine which cost $2,200,000 is

Q51: The half-year convention is not applicable for

Q51: Lunar Products purchased a computer for $13,000

Q54: The purchase of a building would involve

Q56: An improvement made to a machine increased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents