Tom-Kat Inc.'s income before taxes is $340,000 and its tax rate is 30%.Tom-Kat included $40,000 of interest from municipal bonds in the $340,000.There are no other book-tax differences.What is the journal entry to record income tax expense?

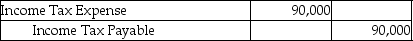

A)

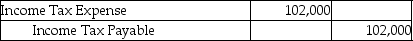

B)

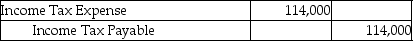

C)

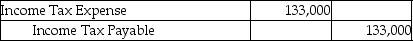

D)

Correct Answer:

Verified

Q2: The amount of income that a company

Q4: Book income refers to the amount of

Q4: Lyon Group's income before taxes is $450,000

Q6: Betta Group's net income after taxes is

Q6: _ differences between book income and taxable

Q8: Taxable income refers to the amount of

Q8: TLR Productions has book income of $650,000,and

Q10: Greene Co.has book income of $425,000,and a

Q11: Caesar Corporation reports municipal interest income on

Q15: The amount of income a company reports

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents