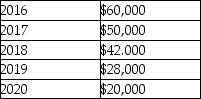

On December 31,2015,The Magic Flute Company reports liabilities with a tax basis of $800,000 and a book basis of $600,000.There was no difference in the asset basis.The difference in liability basis arose from temporary differences that would reverse in the following years:  Assuming a tax rate of 35% for 2015 - 2017 and a rate of 40% for 2018 - 2020,The Magic Flute Co.should report a deferred tax ________ in the amount of ________ on December 31,2015.

Assuming a tax rate of 35% for 2015 - 2017 and a rate of 40% for 2018 - 2020,The Magic Flute Co.should report a deferred tax ________ in the amount of ________ on December 31,2015.

A) liability; $64,500

B) asset; $70,000

C) liability; $74,500

D) asset; $80,000

Correct Answer:

Verified

Q53: What should Greene Co.record as its federal

Q55: Inferno Inc.is embroiled in a lawsuit.In 2015

Q58: Violet,Inc.recorded a deferred tax asset of $35,000

Q59: On December 31,2015,Big Bear Corporation reports liabilities

Q60: Gustav,Inc.uses the accrual basis to account for

Q61: Tetra Corp.recorded book income of $225,000 in

Q73: When assessing realizability of deferred tax assets,

Q74: There are questions as to whether or

Q76: When defining the portion of a deferred

Q78: IFRS uses a two-step process in recording

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents