S & C Company reported income before taxes of $111,000 for the years 2013,2014,and 2015.In 2016 they experienced a loss of $222,000.S & C had a tax rate of 30% in 2013 and 2014,and a rate of 40% is 2015 and 2016.The company elects to carry back the loss.What is the necessary journal entry to record the NOL carryback in the year of the loss?

A)

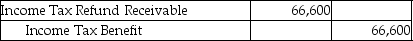

B)

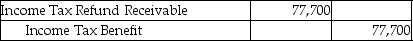

C)

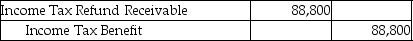

D)

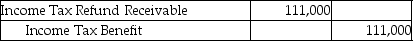

Correct Answer:

Verified

Q89: Caesar Corporation reported income before taxes of

Q91: Muckingjay Inc.opened in 2015.The company reported sales

Q92: Refer to Violet Corporation.Violet reported taxable income

Q96: Greene Co.reported a loss in 2015 of

Q97: Big Bear Sporting Goods opened in 2015.They

Q99: Refer to Violet Corporation.What is the necessary

Q105: What purpose does a carryback or carryforward

Q137: Excluding potentially taxable income from a tax

Q138: Uncertain tax positions may result in a

Q139: Accounting for uncertain tax positions under U.S.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents